Independent service quality survey results

Business current accounts

Published February 2024

As part of a regulatory requirement, an independent survey was conducted to ask approximately 600 customers of each of the 5 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

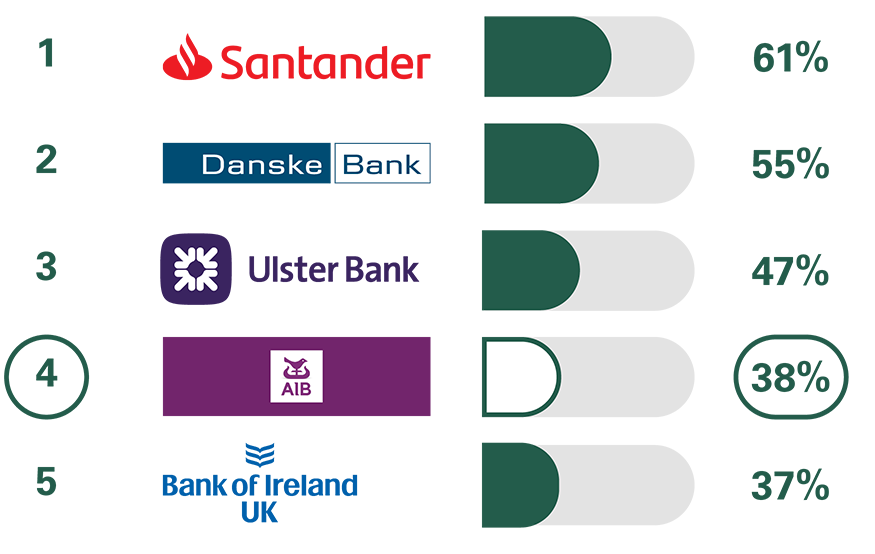

Overall service quality

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

Ranking

Online and mobile banking services

We asked customers how likely they would be to recommend their provider’s online and mobile banking services to other SMEs.

Ranking

SME overdraft and loan services

We asked customers how likely they would be to recommend their provider’s SME overdraft and loan services to other SMEs.

Ranking

Relationship/account management

We asked customers how likely they would be to recommend their provider’s relationship/account management to other SMEs.

Ranking

Services in branches and business centres

We asked customers how likely they would be to recommend their provider’s branch and business centre services to other SMEs.

Ranking

These results are from an independent survey carried out between January 2023 and December 2023 by BVA BDRC as part of a regulatory requirement.

AIB has published this information at the request of the Competition and Markets Authority so you can compare the quality of service from business current account providers. In providing this information, we are not giving you any advice or making any recommendation to you and we can only give you information about our own products and services.

SME customers with business current accounts were asked how likely they would be to recommend their provider, their provider’s online and mobile banking services, services in branches and business centres, SME overdraft and loan services and relationship/account management services to other SMEs.

The results show the proportion of customers of each provider, among those who took part in the survey, who said they were ‘extremely likely’ or ‘very likely’ to recommend each service.

Participating providers: AIB, Bank of Ireland UK, Danske Bank, Santander, Ulster Bank.

Approximately 600 customers a year are surveyed across Northern Ireland and the Republic of Ireland for each provider; results are only published where at least 100 customers have provided an eligible score for that service in the survey period.

3,000 people were surveyed in total.

Results are updated every six months, in August and February.

Information about current account services

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here, and for personal current accounts here.

Supporting the needs of all our customers

Information on the key ways we support the needs of all personal current account customers can be found here.