Convert sales to cash quickly and boost your working capital

AIB (NI) will provide your business with an upfront release (prepayment) of up to 90% of the value of your outstanding customer invoices. You can stay competitive by quickly converting sales to cash, maintaining a healthy cash flow and paying your suppliers in full and on time.

Invoice Finance features

-

Features and benefits

- Invoice Finance quickly converts sales into cash and can release more funds than conventional sources of finance.

- You can take advantage of cash and bulk discounts from suppliers.

- Pay your suppliers promptly thereby improving your company's business to business relations and payment reputation.

- Your business can remain highly competitive and offer attractive credit terms to consolidate and develop customers’ goodwill.

- The availability of finance to your business can grow in line with the growth in sales.

- Your relationship with your customers is not affected by the Invoice Finance arrangement as they are unaware of the funding facility.

- Funds that are released are used only as you need them.

-

Is your business suitable?

Your business may be suitable for Invoice Finance if:

- You have an average on-going funding requirement of £100,000 or more.

- You sell goods or services on credit to other businesses.

- Your business has an ongoing trade debtors' ledger of minimum £150,000.

- You invoice after goods/services are delivered.

- You have a satisfactory quality and spread of debtors.

- You have a sales ledger accounting system and appropriate credit control procedures in place.

- Your business has a positive tangible net worth.

Examples of unsuitable debts for Invoice Finance are:

- Cash sales.

- Sales to individuals.

- Invoicing in advance of delivery of goods or services.

- Export debts may not be suitable if they relate to territories outside of the Organisation for Economic Co-operation and Development (OECD).

- Sales which are suject to formal written contracts (Contractual Debt).

-

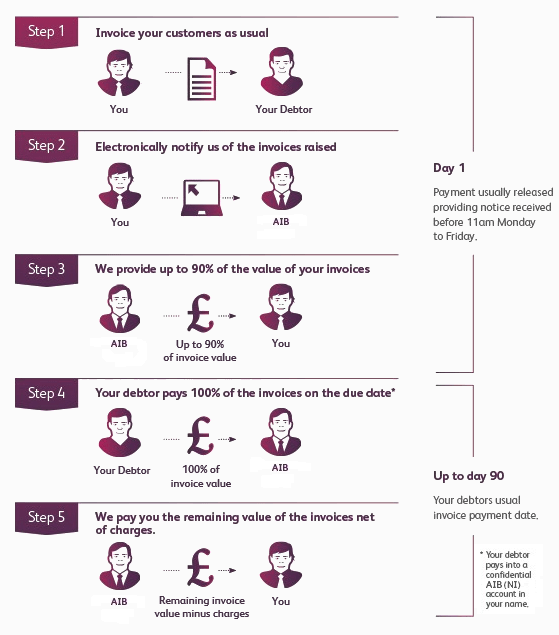

How it works

- You invoice your customers.

- Summary invoice details are then sent to AIB (NI).

- The pre-agreed percentage of up to 90% of the total value of outstanding invoices is made available to you immediately.

- You continue to operate your usual credit control procedures. Invoices are paid by customers to a designated collection account.

- The balancing percentage of the originally financed debt is made available to you, less AIB (NI) costs.

-

Customer example

£'000s

Total Debtors 1,000 Less: Disapproved Debts* (100) Approved Debts 900 Available Funds @ 90% of Approved Debts 810 * Disapproved debts can include aged debts beyond a specified time limit, inter-company debts, disputed debts, contra balances (where you are selling to your suppliers) and cash sales.

-

Costs

- A Discount Charge (similar to an interest charge) is levied on the funds used by the business and charged monthly.

- A Service Fee (related to the on-going management of the facility) is typically charged on an annual fixed fee basis and is charged at the end of each month.

Talk to Us

Simply call 0345 6005 925† or visit your nearest branch. We’ll be happy to answer any questions you might have about applying for Invoice Finance.

† Lines open: Monday - Friday 09:00 - 17:00 (except on bank holidays). Calls may be recorded. Call charges may vary - refer to your service provider.